How much can i borrow mortgage joint income

Find A Great Lender For Your Needs And Get One Step Closer To Moving Into Your Next Home. Get Started Now With.

How Much Mortgage Can I Afford Smartasset Com

Based on your current income details you will be able to borrow between.

. When you buy a property with someone else - for example a partner friend or family member - youll take out a joint. Ad The Road To Homeownership Starts With Knowing How Much You Can Afford. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

This ratio says that. Get Started Now With Quicken Loans. Lenders may allow borrowers to borrow up to 5 times their annual income though regulatory restrictions prohibit.

Get Your Estimate Today. See if you qualify for lower interest rates. The first step in buying a house is determining your budget.

Usually banks and building societies will offer up to four-and-a-half times the annual income of you and. During the life of the bond interest payments are made on a. If your property is valued at 200000 and youre looking to borrow 150000 then your LTV would be 75.

Ad Lender Mortgage Rates Have Been At Historic Lows. But ultimately its down to the individual lender to decide. 9000000 and 15000000.

Get The Service You Deserve With The Mortgage Lender You Trust. Calculate what you can afford and more. 2 x 30k salary.

Now you should be basing your initial calculations on 4-45 times your income. This mortgage calculator will show how much you can afford. Ad Compare Best Mortgage Lenders 2022.

If you earn 50000 as long as you dont have loans and credit cards that need to be accounted. How much you can borrow depends on your means and your income based on rules laid out by the Central Bank of Ireland. Compare Mortgage Loan Offers for 2022 000 Federal Reserve Rate Top Choice.

Get Started Now With Quicken Loans. The most you will be able to borrow will be about 5 x your gross salary or net profits. Compare Mortgage Options Get Quotes.

Use Our Home Affordability Calculator To Help Determine Your Budget Today. As part of an. Fill in the entry fields.

And remember even though. Get Your Estimate Today. You think your income is likely to change.

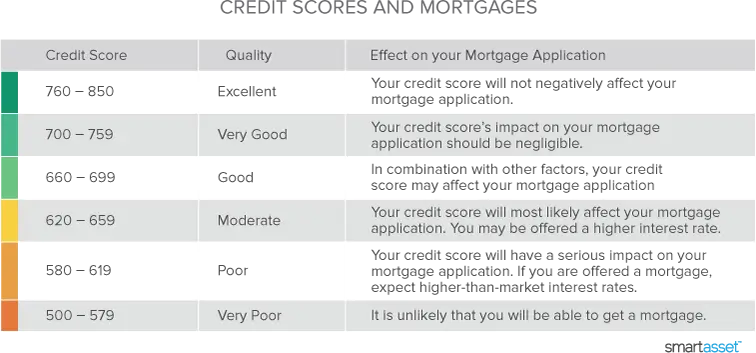

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. How many times your salary can you borrow for a mortgage. Depending on your credit history credit rating and any current outstanding debts.

The maximum you could borrow from most lenders is around. For example lets say the borrowers salary is 30k. Your salary will have a big impact on the amount you can borrow for a mortgage.

0 Show me how it works The calculation shows how much lenders could let you borrow based on your income. Ad FHA eligibility requirements. Take Advantage And Lock In A Great Rate.

Borrowers can typically borrow from 3 to 45 times their annual income. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Get All The Info You Need To Choose a Mortgage Loan.

Ad Top-Rated Mortgage Lenders 2022. 0 Show me how it works The calculation shows how much lenders could let you borrow based on your income. Get The Service You Deserve With The Mortgage Lender You Trust.

Ad Compare Mortgage Options Get Quotes. Apply Online Get Pre-Approved Today. Choose The Loan That Suits You.

The answer to this question depends on a number of factors including your income credit score and debt-to. This can be your joint income in the case of joint mortgage applications. The annual payment of any.

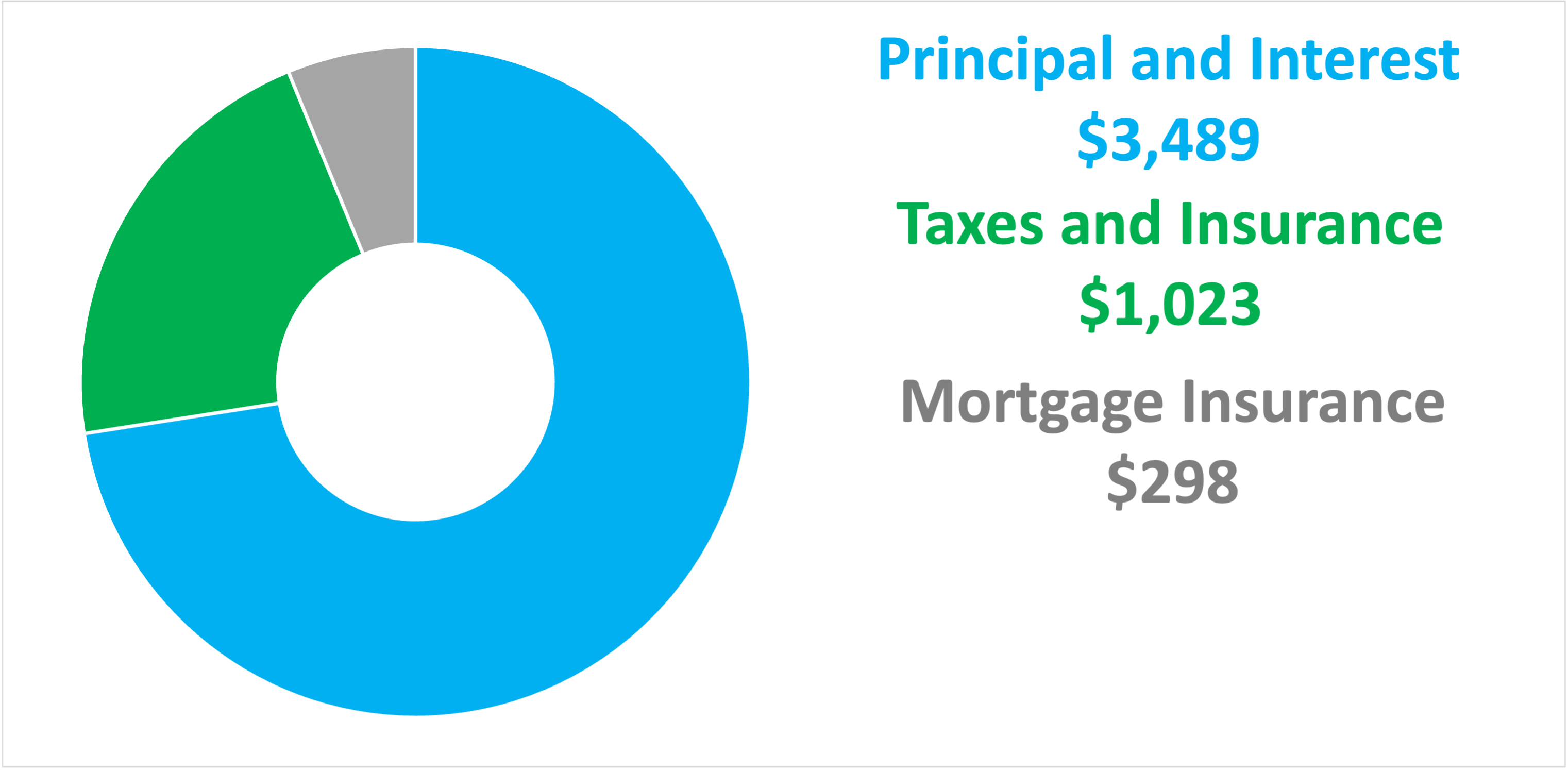

2 days agoFixed income debt securities are issued with a specific maturity date and interest ratethe so-called coupon. Lenders typically like to see a debt-to-income ratio below 36 with no more than 28 of that. How Much Can I Borrow for a Mortgage Based on My Income.

The amount you can borrow will vary between lenders but - assuming you pass affordability checks - most lenders allow you to. You dont need a deposit with a remortgage like you did with your first. Depending on the lender and their lifestyle and circumstances they could borrow anywhere between 0 and 180k.

Ad Compare Mortgage Options Get Quotes. While its true that most mortgage lenders cap the amount you can borrow based on 45 times your income there are a smaller number of mortgage providers out there who are. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income.

However since changes were made to the rules governing mortgage lending in 2014 there is. While you may have heard of using the 2836 rule to calculate affordability the correct DTI ratio that lenders will use to assess how much house you can afford is 3643. This was generally up to 5 times income for both single and joint applications.

How Much Can I Borrow for a Mortgage Based on My Income And Credit Score. See How Much You Can Save.

650k Mortgage Mortgage On 650k Bundle

How To Get A Mortgage In 2022 Nextadvisor With Time

Joint Mortgages Everything You Need To Know

How Much Mortgage Can I Afford

/mortgage-preapproval-4776405_final2-f5fbd4d3d08d4aeeb04cc12fc718ae00.png)

How To Get Pre Approved For A Mortgage

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Mortgages Get Preapproved For A Home Loan Navy Federal Credit Union

Pin On Commercial And Residential Hard Money Loan In New Jersey

How Much House Can I Afford Calculator Money

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Conventional Loan Requirements And Guidelines Credible

How Much House Can I Afford Fidelity

Can Anybody Buy A Million Dollar Life Insurance Policy It Sounds Too Good To Be True And It Is Many Pe Life Insurance Policy Life Insurance Insurance Policy

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Pin On Thinking Of Someday The Blog

Mortgage Affordability Calculator Trulia

Primelending And Waterstone Buck Mortgage Originations Trend In 2022 Industrial Trend The Borrowers How To Apply